Global Acquirer Trends | Q3 2018

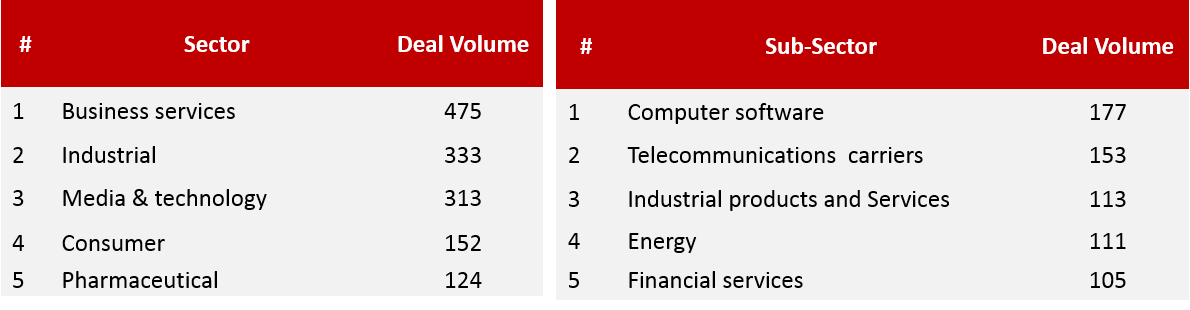

People keep expecting the North American market to cool down but we haven’t seen it yet. In North America, business services remained the most popularly targeted sector, accounting for 475 deals, outpacing industrials (333) and media & technology (313). Much of this reflects the ongoing boom in digital transformation.

Of the 30 core sub-sectors identified by Livingstone, North America’s most active subsector was in computer software (177) followed by telecommunications carriers (153) and industrial products and services (113).

However, there is some evidence that this market is beginning to mature: more than other sectors, the trade in business services companies slowed a bit in Q3, down to 475 from 525, suggesting perhaps that companies are getting more confident about their digital capabilities or that the easy consolidation candidates are now becoming slightly harder to find. You can see from the results this quarter that digital development is on everyone’s mind.

The promise of using technology to drive radically greater efficiency is an old dream but still a good one, particularly now that more and more companies are investing more to make sure they are not outpaced by more tech-savvy competitors.

Read the full report here.